3. On Liquidity

Trading Futures

and Selling Rights

Locating Liquidity in the Water of the Colorado River Basin

01. liquid evaporating out of the cycle of ownership

“You put water into the cup, it becomes the cup...You put water into a bottle, it becomes the bottle; you put water into a teapot, it becomes the teapot…Water can flow or it can crash. Be water, my friend.”

Hito Steyerl, Liquidity Inc. (2014).

A single drop of water comprises 1.5 sextillion individual molecules. Bound together, they flow; they drip; they elude. By definition, the scale of what is referred to as “water” slides from invisible to the naked eye to the planetary. This elusive and diffuse particle of life, composed of hydrogen and oxygen, is recognizable as a cohesive homogeneous substance, yet it is divisible beyond any easily visible realm. The character of the materialized and accumulated substance, referred to as water, is no less elusive. Without a fixed location it is constantly in flux.

The consumption of water globally doubled between 1960 and 2000 and is projected to, by 2030, be consumed twice as quickly as oil. The high mobility of water and thus its uncertain characteristics (such as quality, quantity, and location) in combination with the high cost of artificial transport, has, in many ways, allowed the substance to evade the fate of commodification that has befallen other substances deemed of value, like stone, lumber or oil. Based on the fundamental definition of fungibility — the ability of a good or asset to be exchanged with others of the same type — economists have argued the case for the commodification of the resource as well as the construction of physical and financial infrastructures of transport to allow the liquid to become increasingly liquid, as in convertible to cash.

water is water is water.

The lexicon of metaphors that plague the language of financial discourse also binds water to the financial imaginary and lends the financial system the affordances of water’s ubiquity and the inescapability of humankind's dependency upon it. The use of language gives material form, if only metaphorically, to the abstraction of value inherent in the displacement into numerical notes and incremental measurement. We replace an abstract and diffuse concept with another, unlocatable, intractable, yet more recognizable, materiality — one that can be bought and sold.

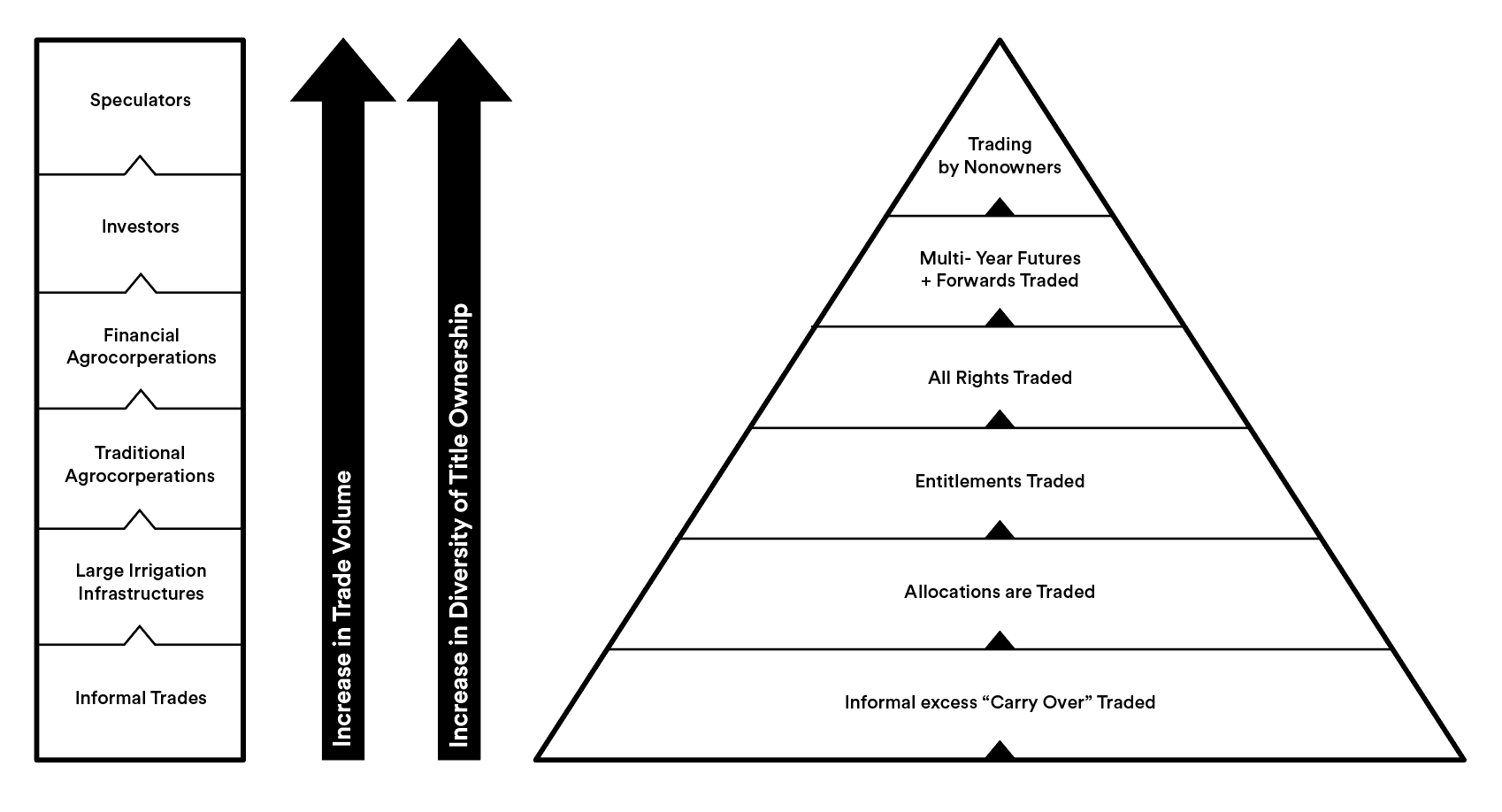

02. How to Grow a Water Market

Water is, thus, not a standard commodity. Its power is made visible through the intersection of complex logic driving ecosystems, as well as the worlds of politics, technology, and finance. The story of water in the American West weaves across multiple timescales from the Gold Rush to the creation of Indian Reservations, through New Deal infrastructure planning initiatives, and finally, into the corporation of exchange markets as reoccurring attempts to possess this ubiquitous, elusive liquid. This paper will trace the morphing ideologies surrounding rights to ownership, connection to physiocratic beliefs surrounding the value of land, the commodification of resources through their inscription into laws and economic systems, as well as materialization into infrastructure.

F03 Los Angeles Aqueduct. ©iofoto